Building Westmont's

Future Together

Our Gift Planning team has experience across a range of giving opportunities, and we are always available for phone calls and personal visits to discuss your particular areas of interest, from designating Westmont in your wills or trusts to exploring life income gifts with generous tax benefits.

We offer supplemental estate planning and tax guidance information on these web pages through our planned giving partner, Crescendo Interactive, Inc. Based in Camarillo, CA, Crescendo has been a preferred service provider for over 30 years among colleges, universities, faith organizations, professional advisors and other nonprofit organizations.

Steven Jay Davis

Senior Director of Gift Planning

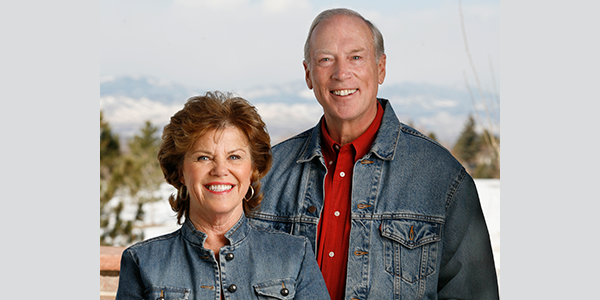

An endowed Scholarship to Honor Dr. John Lundberg

Greg Dixon '66 enrolled at Westmont hoping to sing with the Westmont Quartet, a group he admired as a youngster growing up in Southern California. Happily,

he succeeded in joining the ensemble as a sophomore and junior. The quartet traveled on weekends and in the summer, leaving him little time for anything

besides his psychology major.

But the group that brought him to Westmont also took him away. He and three other quartet members left school to perform as the Blenders on the Lawrence

Welk television show from 1965-67. "It was fun being part of such a great group of people," Greg says. "We have a lot of friends from the show and still do

some work with them."

Greg's wife, Barbara, appeared as a dancer on the program for six years. They married in 1967 after leaving the show and moved to Santa Barbara so Greg

could finish college. He spent nine years doing youth work with the YMCA before switching to human resources. After 20 years in this field, he retired in

1998 from JD Edwards. Barbara taught dance lessons part time while raising their children, David '91 and Diane Pauls '94, and owned a studio in Denver,

Dancing with Barbara, from 1984-2007.

The Dixons, who live in Centennial, Colorado, now focus their energies on volunteer mission work. A founding board member of Global Connection

International, Greg heads up their outreach to churches in Central America. The organization equips pastors there to lead their churches effectively and do

humanitarian work.

Greg told his children many stories about his college years, and he and Barbara were so proud that both graduated from Westmont. David teaches English in

Thailand, and Diane lives in Denver with her husband, Brian Pauls '94, a commercial real estate developer, and their three children.

"We love Westmont and really believe in Christian higher education," Greg says. "We see Westmont as an alternative to secular public and private schools."

The Dixons created an endowed scholarship honoring the late music professor John Lundberg and have made an additional provision in their will for the

college. "We read a lot about colleges with large endowments, but we don't see Westmont on that list," Greg says. "Westmont could really use that kind of

money to help make education more affordable."

Reproduced with permission from the winter 2008 Westmont College Magazine.

For more information about how to create an endowed scholarship, please contact the Office of Gift Planning at (805) 565-6058 or [email protected].

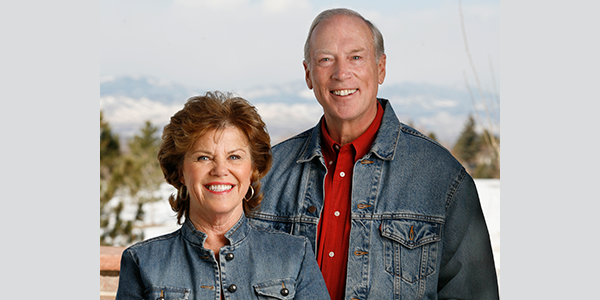

An endowed Scholarship to Honor Dr. John Lundberg

Greg Dixon '66 enrolled at Westmont hoping to sing with the Westmont Quartet, a group he admired as a youngster growing up in Southern California. Happily,

he succeeded in joining the ensemble as a sophomore and junior. The quartet traveled on weekends and in the summer, leaving him little time for anything

besides his psychology major.

But the group that brought him to Westmont also took him away. He and three other quartet members left school to perform as the Blenders on the Lawrence

Welk television show from 1965-67. "It was fun being part of such a great group of people," Greg says. "We have a lot of friends from the show and still do

some work with them."

Greg's wife, Barbara, appeared as a dancer on the program for six years. They married in 1967 after leaving the show and moved to Santa Barbara so Greg

could finish college. He spent nine years doing youth work with the YMCA before switching to human resources. After 20 years in this field, he retired in

1998 from JD Edwards. Barbara taught dance lessons part time while raising their children, David '91 and Diane Pauls '94, and owned a studio in Denver,

Dancing with Barbara, from 1984-2007.

The Dixons, who live in Centennial, Colorado, now focus their energies on volunteer mission work. A founding board member of Global Connection

International, Greg heads up their outreach to churches in Central America. The organization equips pastors there to lead their churches effectively and do

humanitarian work.

Greg told his children many stories about his college years, and he and Barbara were so proud that both graduated from Westmont. David teaches English in

Thailand, and Diane lives in Denver with her husband, Brian Pauls '94, a commercial real estate developer, and their three children.

"We love Westmont and really believe in Christian higher education," Greg says. "We see Westmont as an alternative to secular public and private schools."

The Dixons created an endowed scholarship honoring the late music professor John Lundberg and have made an additional provision in their will for the

college. "We read a lot about colleges with large endowments, but we don't see Westmont on that list," Greg says. "Westmont could really use that kind of

money to help make education more affordable."

Reproduced with permission from the winter 2008 Westmont College Magazine.

For more information about how to create an endowed scholarship, please contact the Office of Gift Planning at (805) 565-6058 or [email protected].

Donor Stories

Learn how our supporters have made an impact through their acts of giving to Westmont. Be inspired by the various ways of giving used by our alumni, parents and friends.